Real Property Tax (RPT) is a levy on real properties which is an obligation that property owners pay annually at their local government unit. We pay real estate tax in Quezon City at the city hall, satellite offices, and recently they have launched the e-services. Our local government also offers 20% discount to paying real property owners if they pay (fully) within the first quarter of the year. Let me share with you how to pay real estate tax in Quezon City.

How to Pay Real Estate Tax

Real Property Tax (RPT) Declaration

Prepare your RPT receipts from last year and a copy of your property’s tax declaration. If you purchased a property under a developer and will be doing this for the first time, your developer should provide you with these. (Unit owners are liable to pay their RPTs two years from the date of their HDMF loan take out).

If the property is already under your name, you can just bring the Real Property Tax Bill from the previous year. Either way, the city assessor can search your records through your Tax Declaration Number that is found on the RPT Declaration and RPT Bill.

Real Estate Tax Assessment

If you will be paying your amilyar at the Quezon City City Hall, you can find the assessment area in the building where Landbank is. They are on the same floor and hallway. In the new normal, it is required to wear face mask and face shield before you enter. The guards check your temperature at the entrance and asks you to sanitize your hands.

When you get in, the City Hall officer will hand you over your number. If you are a senior citizen, PWD, pregnant, or with baby, you are in the priority queue. I had experienced bringing my babies/toddlers there previously and each time I was given a priority queue number.

Inside, there are seats that have X’s where you cannot sit to observe social distancing. The free coffee vending machine is still working but if you have a mask, how can you drink, right?

Once your number is called, approach the counter and present your RPT bill or declaration. The officer will search for your status and will give a printed RPT Bill for the current year.

For those who have not paid their real property tax in the previous years, you need to go to a separate office for delinquent accounts.

Leave the assessment area and go to the payment center.

Payment Area

The payment area has a separate door even though they are on the same room as the assessment. Exit the assessment area and walk towards the entrance of the payment center. The payment center caters to business permits and real estate tax payments.

Same with the assessment lounge, get your queue number at the entrance. Wait for your number to be called. Even though there were a lot of customers, the queue is actually fast. I am always done with assessment and payment within 20-45 minutes.

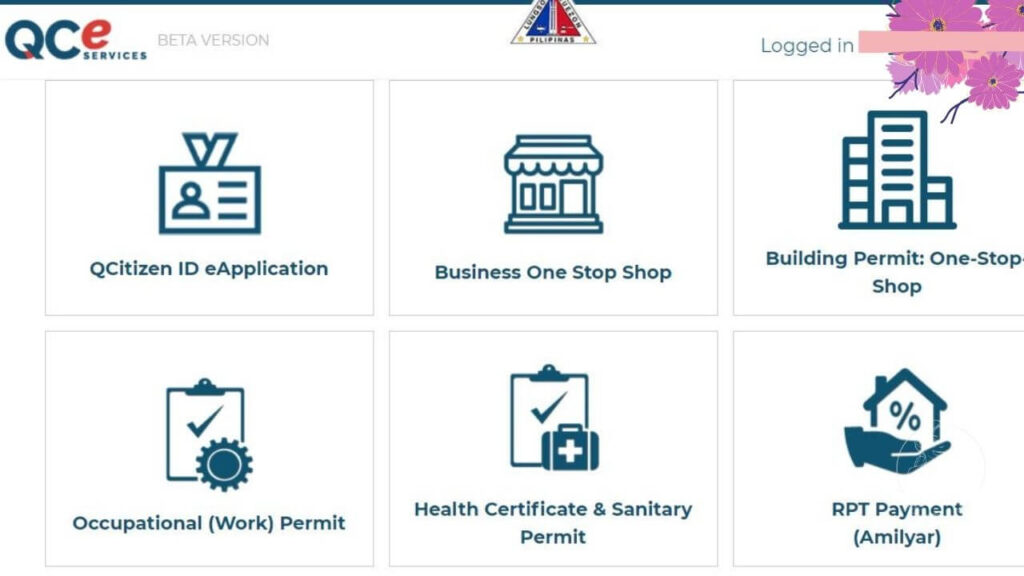

Quezon City E-Services

You can also pay online via the Quezon City E-services. Visit https://qceservices.quezoncity.gov.ph/ and create your own account. Click on the RPT Payment (Amilyar).

Prepare your Tax Declaration Number (TDN) as you will need this when you pay online. After entering your TDN, the system will show you your tax due including the deadline to pay. As of writing, the only payment accepted is for Landbank deposit/transfer. Also, you need to send via email the deposit slip or transfer transaction after.

Satellite Offices

Other than paying via City Hall and or online, you can also visit the satellite offices of the Quezon City government to pay your real estate tax.

Ganito pala mag process ng tax payment ng real estate sa city hall, at ang galing pwede nadin online payment to pay updated na sdin di na need pumila very convenient

Yes mommy. Ang galing na pwede na magbayad online